How To Buy Bitcoin With Credit Card On Cash App

May 5, 2022How to Buy Metal MTL Step-by-Step Guide

June 2, 2022

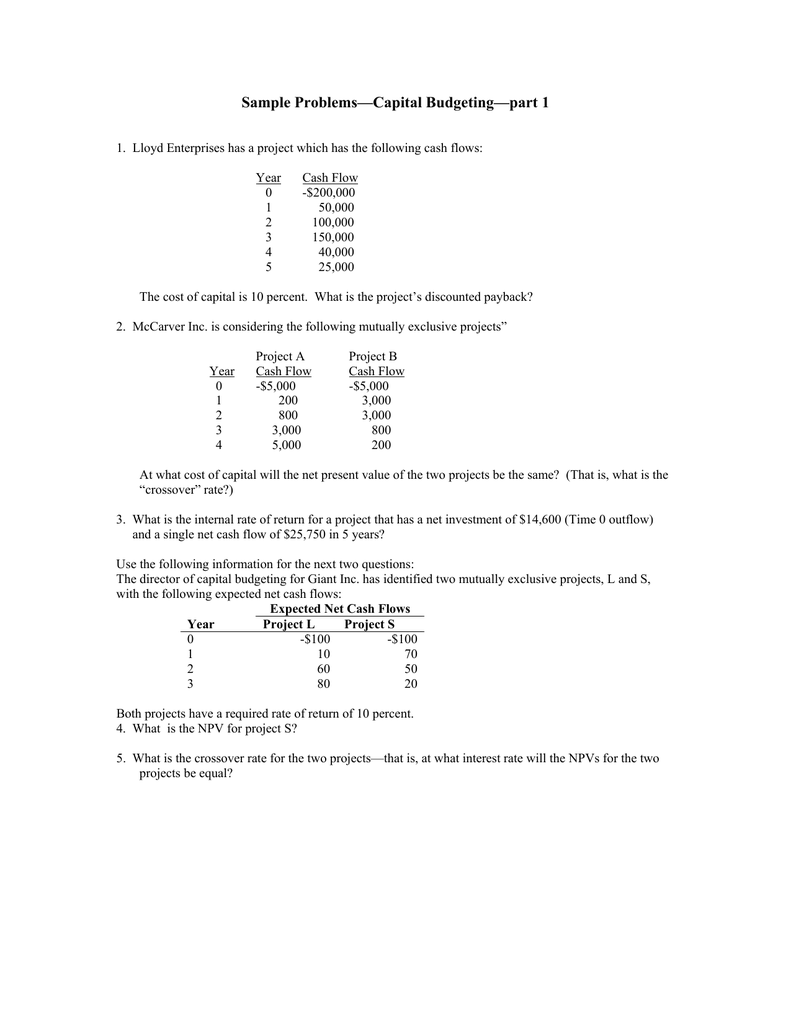

The capital investment consumes less cash in the future while increasing the amount of cash that enters the business later is preferable. The IRR is a useful valuation measure when analyzing individual capital budgeting projects, not those that are mutually exclusive. It provides a better valuation alternative to the payback method, yet falls short on several key requirements. Another drawback is that both payback periods and discounted payback periods ignore the cash flows that occur toward the end of a project’s life, such as the salvage value. A dramatically different approach to capital budgeting is methods that involve throughput analysis.

What are the primary capital budgeting techniques?

Therefore, management will heavily focus on recovering their initial investment in order to undertake subsequent projects. There is no single method of capital budgeting; in fact, companies may find it helpful to prepare a single capital budget using the variety of methods discussed below. This way, the company can identify gaps in one analysis or consider implications across methods that it would not have otherwise thought about.

Capital Budgeting Process Strategies to Eliminate Waste and Maximize Return

The simple rate of return is calculated as the project’s annual net operating income divided by the investment required. The investment required and annual net operating income are provided in Exhibit 11-2. While the payback period method is easy to use, its disadvantages are significant. First, this method does not consider the actual profitability of a project. And second, this method does not consider the time value of money.

Why Is Capital Budgeting Important For Businesses?

- The process starts by generating potential ideas for capital budgeting projects.

- In either case, companies may strive to calculate a target discount rate or specific net cash flow figure at the end of a project.

- Finance Strategists has an advertising relationship with some of the companies included on this website.

- It involves assessing the potential projects at hand and budgeting their projected cash flows.

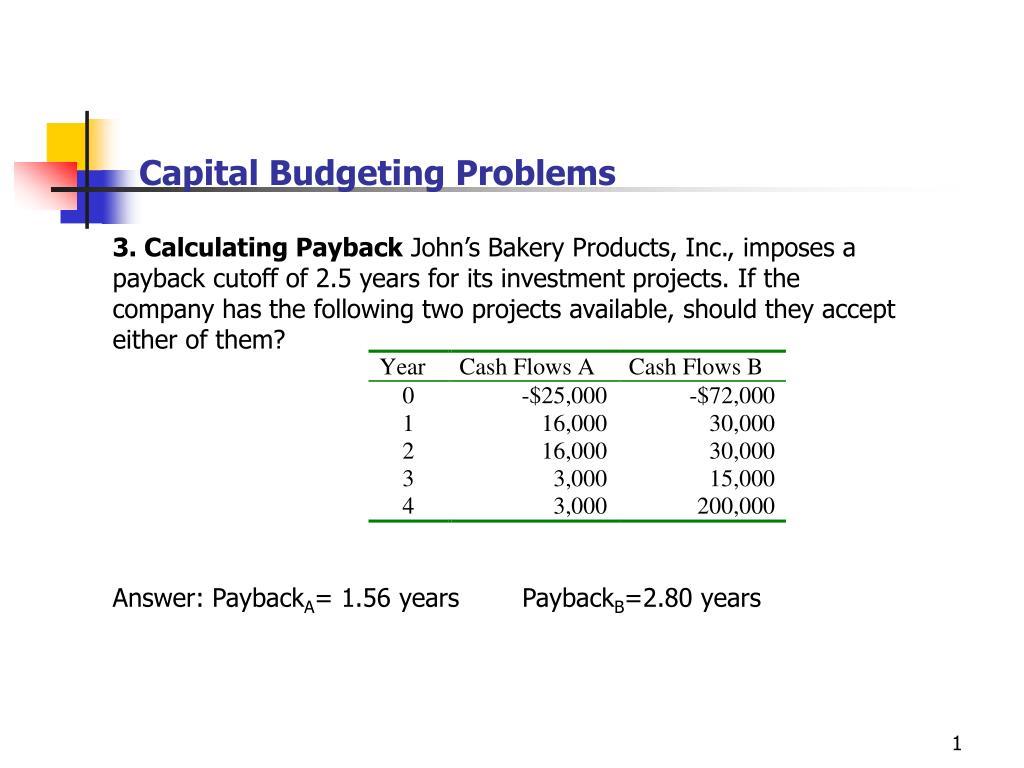

- The payback period is the length of time that it takes for a project to recover the initial cost from the net cash inflows generated by the project.

Once the decision is taken for purchasing a permanent asset, it is very difficult to dispose of those assets without involving huge losses. All organizations make a high volume of direct capital purchases, including vehicles and equipment. Most execute only a limited number of high-value, complex, multi-year projects. The most common capital projects include construction, refurbishment and IT-related projects.

Some common techniques include sensitivity analysis, scenario analysis, and Monte Carlo simulation. It does this by comparing the present value of future cash inflows to the initial cost. When the NPV is positive, the project will likely be profitable and worth pursuing. However, this method doesn’t consider cash flows after the payback period.

Capital Budgeting: Process, Methods, Challenges And Examples

Basically, the discounted payback period factors in TVM and allows one to determine how long it takes for the investment to be recovered on a discounted cash flow basis. Discounted cash flow also incorporates the inflows and outflows of a project. Most often, companies may incur an initial cash outlay for a project (a one-time outflow). Other times, there may be a series of outflows that represent periodic project payments.

It means assessing their likelihood of success in any project. They check whether a project threatens the company’s resources or is a secure investment. When the project passes the feasibility study, it needs approval. Senior managers review all the data and decide whether to proceed. They consider the project’s value, fit with business goals, and potential challenges. Once they approve, the project receives funding, and planning begins.

An annuity is a series of equal payments entered as years x to x. A lump sum is a single receipt or cash payment in the future entered as a single year. The formula to compute the discount factor used for the internal rate of return method is presented in Exhibit 11-5.

However, it uses assumptions similar to those in the NPV method, requiring accurate cash flow estimates. As a result, payback analysis is not considered a true measure of how profitable a project is but instead provides a rough estimate of how quickly an initial investment can be recouped. Examples of capital budgeting include accounting basics for an llc purchasing and installing a new machine tool in an engineering firm, and a proposed investment by the company in a new plant or equipment or increasing its inventories. A capital budgeting technique refers to the way we evaluate whether or not the capital budgeting project being evaluated should be accepted or not.